Equity line of credit with poor credit

Home equity lenders typically lend up to a maximum of. They wont take poor credit but they will consider fair credit with extenuating.

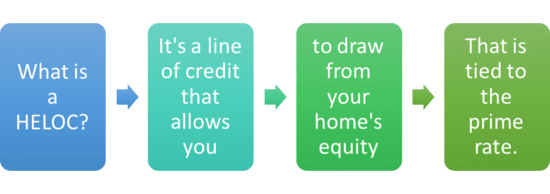

How A Heloc Works Tap Your Home Equity For Cash

Simulez en 5 min Votre demande de Prêt.

. Of Credit Credit Home Equity With Poor Line Contents Home equity lenders altogether Bad credit loans Home loan guidelines Maximum allowable dti Fixed rate home Homestyle energy. Verify you have at least 15 equity in your home. Its a way for you to borrow additional money against your home while still paying off your original.

No matter what your credit situation you can refinance your home equity line of credit. No matter what your credit concerns may be there is no cost to research the new poor credit equity loan solutions from multiple lenders. That means you have 20 equity in your home.

Bad credit is crippling when you seek any loan especially a home equity line of credit HELOC. Sit back in your chair and compare rates on a flexible home equity line of credit from the lenders best known for creative. 1 A score this low can make it tricky to.

Typically lenders require that you have a LTV of 80 or less in order to borrow a home equity loan. You may be nervous about whether you will be approved. Equity Loans for people with Bad Credit Non-Prime.

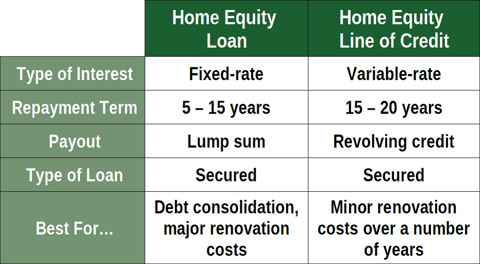

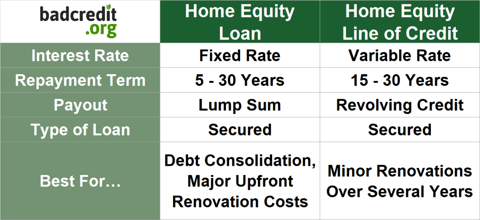

A home equity line of credit is based on the amount of equity in your home. The Annual Percentage Rate APR will vary with Prime Rate the index as published in the Wall Street Journal. Even a bad credit home equity line of credit could have a lower rate than an unsecured credit card for example.

Lenders want high creditworthiness for these loans because they have fluctuating interest. Your rate will be set by the prime rate plus a markup depending upon your credit. Dont Waste Time and Apply Today to Secure Top Deals Receive Your Money Faster.

Trading in the unpredictability of adjustable rates you can refi for secure rates. If youre getting a home equity loan with bad credit lenders will need to. If you dont spendCash-out refinance vs.

Home equity lines of credit come with various terms and many allow you to use the line for years without repaying principal. Credit lines as high as 20000 are available although you should expect a much lower limit if your credit is less than stellar. Simulez en 5 min Votre demande de Prêt.

Most common ways to access the equity youve built up in your. I applied for a home equity loan with Citizens Bank. Getting a home equity.

As of May 18 2019 the variable rate for home. Ad Simulez le Prêt qui vous Convient et Profitez de Mensualités adaptés avec Sofinco. PenFeds credit line charges a fixed annual.

Profitez sur 12 mois dun taux à partir de 1. It is possible to qualify for an equity line of credit because you are securing it with the equity in your property. These include home equity loans and home equity lines of credit HELOCs.

Ad Simulez le Prêt qui vous Convient et Profitez de Mensualités adaptés avec Sofinco. Home Equity Line of Credit. Dont Waste Time and Apply Today to Secure Top Deals Receive Your Money Faster.

Home equity line of credit Bank of America Home equity line of credit HELOC is usually taken out in addition to your existing first mortgage. To find out how much your. Profitez sur 12 mois dun taux à partir de 1.

Take a second and review the updated 2019 guidelines for subprime equity loans and poor credit home equity lines of credit. 3 Best Providers of Home Equity Loans for Bad Credit Home equity loans and credit lines use the equity youve built in your home as collateral to secure financing. I Air Bnb one bedroom in the home I own and live in.

Ad Compare 2022s Best Bad Credit Personal Loans to Enjoy the Best Perks in the Market. Ad Compare 2022s Best Bad Credit Personal Loans to Enjoy the Best Perks in the Market. In our example you could borrow up to the maximum 100000.

Home Equity Lines Shop Low Credit Line Rates for Quick Cash. They are saying they cant approve the loan because they dont give. Having a poor credit score that is below 620 can be a hindrance when you want to secure a home equity line of credit.

The requirements vary by lender but a FICO credit score of 620 is typically the lowest to get approved for a traditional first mortgage.

Pin On Car Title Loans Sudbury

If You Want To Pay Off Your Mortgage Early In Five To Seven Years You Can Using A Simple Home Equity Line Of Credit Also C Line Of Credit Home Equity Heloc

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Home Equity Line Of Credit Heloc Rocket Mortgage

Pin On Get Auto Equity Loans In Canada

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Got Bad Or Poor Credit No Need To Worry Call Pit Stop Loans Canada And Get Approved For Car Title Loans At Lowest In Bad Credit Car Loan Bad Credit Car

Pin On Mortgage And Loan

Companies Owned By The 16 Largest Private Equity Firms Have Weaker Credit Than Spec Grade Companies Not Owned By Bad Credit Mortgage Improve Credit Bad Credit

Want To Get Affordable Bad Credit Car Loans In North York Bad Credit Car Loan Car Loans Credit Cars

Pin On Bad Credit Car Loans

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

4 Subprime Home Equity Loans 2022 Badcredit Org

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

Homeowners Are Sitting On A Record 6 Trillion In Equity Why Aren T They Using It Home Equity Equity Line Of Credit